AFGE Local 17 Podcast Recap: Navigating Federal Retirement Benefits in Uncertain Times

“Can I afford to leave my job?” That’s the question on the minds of many federal employees today. With buyout offers, early retirement incentives, and the looming threat of reductions in force (RIF), it’s beginning to feel like a high-stakes game show. In a recent episode of the AFGE Local 17 podcast, President Doug Massey and retirement expert Josh Silverman from Benefit Architects broke down the complex world of federal retirement benefits, offering clarity and guidance for employees facing tough decisions.

Table of Contents

Understanding the Landscape: VERA vs. DRP and Their Retirement Benefits Implications

Josh began by explaining two key acronyms federal employees need to understand: VERA and DRP. VERA (Voluntary Early Retirement Authority) is a legitimate early retirement option approved by Congress. It allows employees to retire earlier than usual without a reduction in annuity and retain retirement benefits like FEHB and FEGLI, even if they haven’t met the standard five-year coverage requirement.

DRP (Deferred Resignation Program), on the other hand, is not a retirement program. It was not approved by Congress and, as Josh put it, seems more like a tool to encourage voluntary departures. Employees who accept the DRP waive key rights—including union representation in class action suits. While DRP might benefit those already planning to retire soon, it carries significant risks to retirement benefits.

Book a One-on-One: Your Retirement Strategy Is Personal

One of the central themes of the podcast is that retirement is not one-size-fits-all. Whether you’re single, married, divorced, early career or nearing 40 years of service, your situation is unique. That’s why Josh and his team at Benefit Architects offer free one-on-one appointments for AFGE members via unionretirement.org. These meetings are designed to walk employees through their options based on their personal retirement benefits and circumstances.

The Three-Legged Stool of FERS and Its Role in Retirement

Josh described the Federal Employees Retirement System (FERS) as a three-legged stool:

- Pension (Annuity) – Based on years of service and high-3 average salary.

- Social Security – Available starting at age 62, with incentives to wait until 70.

- TSP (Thrift Savings Plan) – Your personal retirement savings, which should be nurtured just like the other two legs.

Each leg is vital to ensuring a stable retirement benefit package. Josh emphasized the importance of contributing as much as possible to TSP while you’re still working.

Key Milestones That Shape Your Federal Retirement Benefits

For regular FERS retirement, employees are eligible under the following conditions:

- MRA + 30 years of service

- Age 60 + 20 years

- Age 62 + 5 years

There’s also the MRA+10 option, but it comes with a 5% permanent reduction for each year under age 62 and no supplement.

What About the FERS Supplement and Other Retirement Benefits Add-Ons?

The FERS supplement bridges the gap between retirement and age 62. It’s calculated as a percentage of your projected Social Security benefit, based on years of federal service (e.g., 30 years = 75%). However, if you retire early, you won’t receive the supplement until you reach minimum retirement age (MRA), and there’s an earnings limit that may reduce this part of your retirement benefits.

TSP Strategy: Making the Most of Your Retirement

Josh used a creative analogy to describe TSP funds:

- G Fund: Safe like a savings account—low risk, low return.

- F Fund: Bonds—can lose money.

- C Fund: The “casino” (S&P 500).

- S Fund: Small-cap “mini casino.”

- I Fund: International “casino.”

For those near retirement, stability is key. For those further out, downturns can be opportunities to grow their retirement portfolio.

Disability Retirement Benefits and Other Federal Options

Josh also discussed disability retirement—a valid option for those with medical conditions and reasonable accommodations already in place. Though the process is longer and taxable, it can be a better option than DRP for some. There are also options like postponed and deferred annuities for those with at least 5 years of service who leave before reaching retirement age, ensuring some level of retirement benefits down the road.

Survivor Options and Health-Related Retirement Benefits

Employees can choose to leave their spouses 50%, 25%, or 0% of their pension, but FEHB continuation for survivors depends on electing at least a partial survivor benefit. Health insurance premiums remain the same in retirement, though they switch from pre-tax to post-tax and monthly instead of biweekly—an important factor when calculating total retirement benefits.

Legislative Threats to Federal Retirement Benefits

Josh warned of ongoing legislative proposals that could impact federal retirement benefits:

- Raising employee contributions to 4.4% for all.

- Eliminating the FERS supplement.

- Changing high-3 to high-5 for pension calculations.

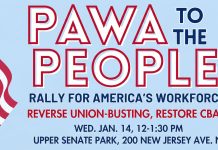

The union is fighting these efforts, but awareness is key to protecting your retirement benefits.

Listen to the Podcast on Spotify

If you prefer to listen to your podcasts on Spotify, we have you covered. Use the embedded player or click here to listen on Spotify.

Bottom Line: Take Control of Your Federal Retirement Benefits

Your retirement decision is one of the most important you’ll ever make. Don’t make it alone. Schedule a personalized session at unionretirement.org and get the facts specific to your situation. As Josh reminded listeners, “Most people only retire once. I help people retire five or six times a day.”